March 31, 202127, 2024

To the Stockholders of Computer Programs and Systems,TruBridge, Inc.:

You are invited to attend the 20212024 Annual Meeting of Stockholders of Computer Programs and Systems,TruBridge, Inc. (the “Company”) on Thursday, May 13, 20219, 2024 at 8:00 a.m., Central Time. This year we will be conducting the annual meeting online for the safety ofvia live webcast in order to allow our stockholders and other attendees.attendees to participate from any location and to reduce the environmental impact of our annual meeting. Details regarding how to participate in the virtual annual meeting and the business to be conducted are more fully described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

We have elected to take advantage of Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their stockholders on the Internet. We believe that the rules will allow us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of the annual meeting.

Your vote, whether in attendance on May 13, 20219, 2024 or by proxy, is important. Please review the instructions on each of your voting options described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement and the Notice of Internet Availability of Proxy Materials you received in the mail. Even if you plan to participate in the virtual annual meeting, I urge you to vote as soon as possible.

| Sincerely, |

|

Glenn P. Tobin |

| Chairperson of the Board |

COMPUTER PROGRAMS AND SYSTEMS,TRUBRIDGE, INC.

6600 Wall54 St. Emanuel Street

Mobile, Alabama 3669536602

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD THURSDAY, MAY 13, 20219, 2024

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 20212024 Annual Meeting of Stockholders of Computer Programs and Systems,TruBridge, Inc. (the “Company”) will be held at 8:00 a.m., Central Time, on Thursday, May 13, 2021.9, 2024. In light of the COVID-19 (coronavirus) pandemic, for the safety oforder to allow our stockholders and other attendees to participate from any location and taking into account federal, state and local guidance that has been issued,to reduce the environmental impact of our annual meeting, we have determined that the annual meeting will be held in a virtual meeting format only via the Internet. You may participate in and vote and submit questions during the annual meeting via the Internet at www.proxydocs.com/CPSI.TBRG. The annual meeting is being held for the following purposes:

| 1. | To elect |

| 2. | To approve on a non-binding advisory basis the compensation of the Company’s named executive officers (“NEOs”); |

| 3. | To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accountants for the year ending December 31, |

| 4. | To transact such other business as may properly come before the annual meeting or any adjournment thereof. |

These items of business are more fully described in the Proxy Statement accompanying this Notice. The annual meeting may be adjourned from time to time without notice other than announcement at the meeting or at adjournments thereof, and any business for which notice is hereby given may be transacted at any such adjournment.

The Board of Directors has set March 19, 202115, 2024 as the record date for the annual meeting. Only holders of record of the Company’s common stock at the close of business on the record date will be entitled to notice of, and to vote at, the annual meeting.

To participate in the annual meeting virtually via the Internet, please visit www.proxydocs.com/CPSI.TBRG. In order to attend, you must register in advance at www.proxydocs.com/CPSI.TBRG. In order to register, you will need the control number included on your Notice of Internet Availability of Proxy Materials or proxy card if you request a hard copy of the proxy materials. Upon completing your registration, you will receive further instructions via email, including information about when you should expect to receive your unique link that will allow you access to the meeting and to vote and submit questions during the meeting. You will not be able to attend the annual meeting in person.

Whether or not you plan to participate in the virtual annual meeting, we urge you to review these materials carefully, which are available at www.proxydocs.com/CPSI.TBRG. We also encourage you to vote by (i) following the instructions on the Notice that you received from your broker, bank or other nominee if your shares are held beneficially in “street name” or (ii) one of the following means if your shares are registered directly in your name

i

with the Company’s transfer agent:

| • | By Internet: Go to the website www.proxypush.com/TBRG and follow the instructions. You will need the control number included on your Notice of Internet Availability of Proxy Materials or proxy card to obtain your records and create an electronic voting instruction form. |

| • | By Telephone: To vote over the telephone, dial toll-free 866-509-1050 using any touch-tone telephone and follow the recorded instructions. You will be asked to provide the control number included on your Notice of Internet Availability of Proxy Materials or proxy card. |

i

| • | By Mail: You may request from the Company a hard copy of the proxy materials, including a proxy card, by following the instructions on your Notice of Internet Availability of Proxy Materials. If you request and receive a proxy card, please mark your selections on the proxy card, date and sign your name exactly as it appears on the proxy card and mail the proxy card in the pre-paid envelope that will be provided to you. Mailed proxy cards must be received no later than May 8, 2024 in order to be counted for the annual meeting. |

By Internet: GoOn March 4, 2024, we changed our name from Computer Programs and Systems, Inc. to TruBridge, Inc. and our ticker was changed to “TBRG.” In the Proxy Statement accompanying this Notice, the terms “TruBridge,” “the Company,” “we,” “us” and “our” refer to TruBridge, Inc. following the name change and Computer Programs and Systems, Inc. prior to the website www.proxypush.com/CPSI and follow the instructions. You will need the control number included on your Notice of Internet Availability of Proxy Materials or proxy card to obtain your records and create an electronic voting instruction form.

By Telephone: To vote over the telephone, dial toll-free 866-509-1050 using any touch-tone telephone and follow the recorded instructions. You will be asked to provide the control number included on your Notice of Internet Availability of Proxy Materials or proxy card.

By Mail: You may request from the Company a hard copy of the proxy materials, including a proxy card, by following the instructions on your Notice of Internet Availability of Proxy Materials. If you request and receive a proxy card, please mark your selections on the proxy card, date and sign your name exactly as it appears on the proxy card and mail the proxy card in the pre-paid envelope that will be provided to you. Mailed proxy cards must be received no later than May 12, 2021 in order to be counted for the annual meeting.change.

By order of the Board of Directors, |

|

| Glenn P. Tobin |

| Chairperson of the Board |

ThisThe accompanying Proxy Statement and the accompanying instruction form or proxy card are being made available on or about March 31, 2021.27, 2024.

ii

| Page | |||||||

| 7 | |||||||

| 12 | |||||||

| 13 | |||||||

| 13 | |||||||

| 14 | |||||||

| 14 | |||||||

| 14 | |||||||

Process for Identifying and Evaluating Nominess for Directors | 22 | ||||||

| 22 | |||||||

Equity Ownership and Retention Requirements for Non-Employee Directors | |||||||

| 24 | |||||||

| 25 | |||||||

| 36 | |||||||

| 37 | |||||||

| 39 | |||||||

| 40 | |||||||

| 42 | |||||||

| 42 | |||||||

| 49 | |||||||

Security Ownership of Certain Beneficial Owners and Management | |||||||

Policy for the Review and Approval of Related Person Transactions | |||||||

Proposal 2: Advisory Vote on Compensation of Our Named Executive Officers | |||||||

Proposal 3: Ratification of Appointment of Independent Registered Public Accountants | |||||||

iii

iii

| Page | ||||

iv

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD THURSDAY, MAY 13, 20219, 2024

This Proxy Statement, along with the accompanying Notice of Annual Meeting of Stockholders, contains information about the 20212024 Annual Meeting of Stockholders (the “Annual Meeting”) of Computer Programs and Systems,TruBridge, Inc., including any adjournments or postponements of the Annual Meeting. We are holding the Annual Meeting on Thursday, May 13, 20219, 2024 at 8:00 a.m., Central Time, in a virtual meeting format only via the Internet. Stockholders may participate in and vote and submit questions during the Annual Meeting via the Internet at www.proxydocs.com/CPSI.TBRG. In order to attend, you must register in advance at www.proxydocs.com/CPSI.TBRG. You will need the control number included on your Notice of Internet Availability of Proxy Materials or proxy card if you request a hard copy of the proxy materials.

This Proxy Statement relates to the solicitation of proxies by our Board of Directors (the “Board” or “Board of Directors”) for use at the Annual Meeting.

On or about March 31, 2021,27, 2024, we began sending a Notice of Internet Availability of Proxy Materials to all stockholders entitled to vote at the Annual Meeting.

We encourage all of our stockholders to vote prior to or during the Annual Meeting, and we hope the information contained in this document will help you decide how you wish to vote.

On March 4, 2024, we changed our name from Computer Programs and Systems, Inc. to TruBridge, Inc. and our ticker was changed to “TBRG.” In this Proxy Statement, the terms “TruBridge,” “the Company,” “we,” “us” and “our” refer to TruBridge, Inc. following the name change and Computer Programs and Systems, Inc. prior to the name change.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be held on May 13, 20219, 2024

The Notice of Annual Meeting of Stockholders, the Proxy Statement and the Company’s 20202023 Annual Report to Stockholders are available free of charge to view, print and download at www.proxydocs.com/CPSI.TBRG.

Additionally, you can find a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2020,2023, including financial statements and schedules thereto, on the website of the Securities and Exchange Commission, or the SEC, at www.sec.gov, or in the “Corporate Information” section of our website at http://investors.cpsi.cominvestors.trubridge.com (under the “2021“2024 Annual Meeting Materials” link). You may also obtain a printed copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2020,2023, including financial statements and schedules thereto, free of charge, from us by sending a written request to: Computer Programs and Systems,TruBridge, Inc., 6600 Wall54 St. Emanuel Street, Mobile, Alabama 36695,36602, Attn: Corporate Secretary. Exhibits will be provided upon written request and payment of an appropriate processing fee.

1

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

Why is the Company soliciting my proxy?

The Board is soliciting your proxy to vote at the 20212024 Annual Meeting of Stockholders to be held online on Thursday, May 13, 20219, 2024 at 8:00 a.m., Central Time, and any adjournments of the meeting, which we refer to as the “Annual Meeting.” This Proxy Statement along with the accompanying Notice of Annual Meeting of Stockholders summarizes the purposes of the meeting and the information you need to know to vote at the Annual Meeting.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to each stockholder of record, we are furnishing proxy materials, including this Proxy Statement and our 20202023 Annual Report to Stockholders, by providing access to such documents on the Internet. Stockholders will not receive printed copies of the proxy materials unless they request them. Instead, commencing on or about March 31, 2021,27, 2024, a Notice of Internet Availability of Proxy Materials (the “Notice”) was sent to our stockholders, which instructs you on how to access and review the proxy materials on the Internet.Internet, was sent to our stockholders. The Notice also instructs you on how to submit your proxy via the Internet. If you would like to receive a paper or email copy of our proxy materials, please follow the instructions for requesting such materials in the Notice.

Why am I receiving these materials?

Our Board is providing these proxy materials to you on the Internet or, upon your request, will deliver printed versions of these materials to you by mail, in connection with the Annual Meeting, which will take place on May 13, 2021.9, 2024. Stockholders are invited to participate in the Annual Meeting and are requested to vote on the proposals described in this Proxy Statement.

What is included in these materials?

These proxy materials include:

our Proxy Statement for the Annual Meeting; and

our 2020 Annual Report to Stockholders, which includes our Annual Report on Form 10-K, including our audited consolidated financial statements.

| • | our 2023 Annual Report to Stockholders, which includes our Annual Report on Form 10-K, including our audited consolidated financial statements. |

If you request printed versions of these materials by mail, these materials will also include the proxy card for the Annual Meeting.

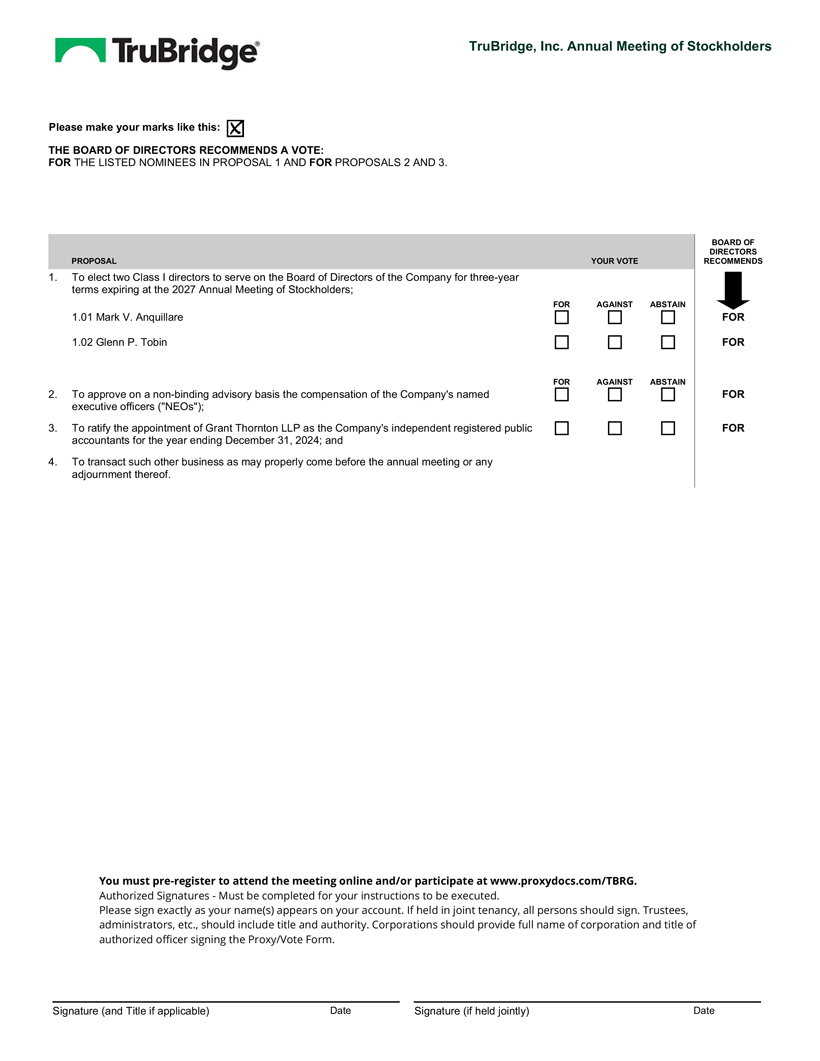

What proposals will be voted on at the Annual Meeting?

At the Annual Meeting, we will ask you to:

| Proposal 1: | Elect | |||

| Proposal 2: | Approve on an advisory basis the compensation of our NEOs, as described in the Compensation Discussion and Analysis, executive compensation tables and accompanying narrative in this Proxy Statement; and | |||

| Proposal 3: | Ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accountants for the year ending December 31, | |||

What is the Board’s voting recommendation?

The Company’s Board of Directors recommends that you vote your shares FOR the election of the Class I director nomineenominees set forth in this Proxy Statement; FOR the approval, on an advisory basis, of the compensation of our NEOs, as described in the Compensation DiscussionNEOs; and Analysis, executive compensation tables and accompanying narrative in this Proxy Statement; and FOR the ratification of the appointment of Grant Thornton LLP as the Company’s independent registered public accountants for the year ending December 31, 2021.2024.

Unless instructed to the contrary, the shares represented by the proxies will be voted FOR the listed nomineenominees in Proposal 1, FOR Proposal 2, and FOR Proposals 2 andProposal 3.

What shares owned by me can be voted?

All shares owned by you as of the close of business on March 19, 202115, 2024 (the “Record Date”) may be voted. You may cast one vote per share of common stock that you held on the Record Date. These include shares that are: (1) held directly in your name as the stockholder of record, and (2) held for you as the beneficial owner through a stock broker, bank or other nominee. At the close of business on the Record Date, there were 14,656,96714,652,956 shares of the common stock of the Company, par value $0.001 per share, outstanding. Each stockholder is entitled to one vote in person or by proxy for each share of common stock held on all matters properly to come before the Annual Meeting.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most of the Company’s stockholders hold their shares through a stock broker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with the Company’s transfer agent, American Stock Transfer & Trust Company, LLC,Computershare Inc., you are considered the stockholder of record with respect to those shares, and the Notice is being sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to the persons named as proxy holders, J. Boyd Douglas,Christopher L. Fowler, the Company’s President and Chief Executive Officer, and Matt J. Chambless,Vinay Bassi, the Company’s Chief Financial Officer, Secretary and Treasurer, or to vote during the Annual Meeting. If you request printed copies of the proxy materials, the Company will provide a proxy card for you to use. You may also vote by Internet or telephone, as described below under the heading “How can I vote my shares without participating in the Annual Meeting?”

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you are invited to participate in the Annual Meeting. You also have the right to direct your broker, bank or other nominee on how to vote these shares. The Notice or voting instruction form that you receive from your broker or nominee should include instructions for you to direct your broker, bank or other nominee how to vote your shares. You may also vote by Internet or telephone, as described below under “How can I vote my shares without participating in the Annual Meeting?” However, shares held in “street name” may be voted during the meeting by you only if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

How can I participate in the Annual Meeting?

In light of the COVID-19 (coronavirus) pandemic, for the safety oforder to allow our stockholders and other attendees to participate from any location and taking into account federal, state and local guidance that has been issued,to reduce the environmental impact of our Annual Meeting, we have determined that the Annual Meeting will be held in a virtual meeting format only via the Internet. You may participate in and vote and submit questions during the Annual Meeting via the Internet at www.proxydocs.com/CPSI.TBRG.

In order to attend the Annual Meeting, you must register in advance at www.proxydocs.com/CPSI.TBRG. In order to register, you will need the control number included on your Notice or proxy card if you request a hard copy of the proxy materials. Upon completing your registration, you will receive further instructions via email, including information about when you should expect to receive your unique link that will allow you access to the meeting and to vote and submit questions during the meeting. Please be sure to follow the instructions found on your proxy card and/or voting instruction form and subsequent instructions that will be delivered to you via email.

3

How can I vote my shares during the Annual Meeting?

Shares held directly in your name as the stockholder of record or shares held beneficially in “street name” may be voted during the Annual Meeting. To vote during the virtual Annual Meeting, you must first register at www.proxydocs.com/CPSI.TBRG. Upon completing your registration, you will receive further instructions via email, including information about when you should expect to receive your unique link that will allow you access to the meeting and to vote and submit questions during the meeting. If you are the beneficial owner of shares held in “street name,” you must obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares in order to vote during the meeting. Even if you plan to participate in the Annual Meeting, the Company recommends that you vote your shares in advance as described below so that your vote will be counted if you later decide not to participate in the Annual Meeting.

How can I vote my shares without participating in the Annual Meeting?

Whether you hold your shares directly as the stockholder of record or beneficially in “street name,” you may direct your vote by proxy without participating in the Annual Meeting. If you are the stockholder of record, you can vote by proxy by one of the following means:

By Internet: Go to the website www.proxypush.com/CPSI and follow the instructions. You will need the control number included on your Notice or proxy card to obtain your records and create an electronic voting instruction form.

| • | By Internet: Go to the website www.proxypush.com/TBRG and follow the instructions. You will need the control number included on your Notice or proxy card to obtain your records and create an electronic voting instruction form. |

By Telephone: To vote over the telephone, dial toll-free 866-509-1050 using any touch-tone telephone and follow the recorded instructions. You will be asked to provide the control number included on your Notice or proxy card.

| • | By Telephone: To vote over the telephone, dial toll-free 866-509-1050 using any touch-tone telephone and follow the recorded instructions. You will be asked to provide the control number included on your Notice or proxy card. |

By Mail: You may request a hard copy of the proxy materials, including a proxy card, by following the instructions on your Notice. If you request and receive a proxy card, please mark your selections on the proxy card, date and sign your name exactly as it appears on the proxy card and mail the proxy card in the pre-paid envelope that will be provided to you. Mailed proxy cards must be received no later than May 12, 2021 in order to be counted for the Annual Meeting.

| • | By Mail: You may request a hard copy of the proxy materials, including a proxy card, by following the instructions on your Notice. If you request and receive a proxy card, please mark your selections on the proxy card, date and sign your name exactly as it appears on the proxy card and mail the proxy card in the pre-paid envelope that will be provided to you. Mailed proxy cards must be received no later than May 8, 2024 in order to be counted for the Annual Meeting. |

If you hold your shares beneficially in “street name,” please follow the instructions provided in the Notice, or, if you request printed copies of proxy materials, on the proxy card or voting instruction form. We urge you to review the proxy materials carefully before you vote. These materials are available at www.proxydocs.com/CPSI.TBRG.

Can I revoke my proxy or change my vote?

You may revoke your proxy or change your voting instructions prior to the vote during the Annual Meeting. You may enter a new vote by using the Internet or telephone or by mailing a new proxy card or new voting instruction form bearing a later date (which will automatically revoke your earlier voting instructions), which new proxy card must be received by May 12, 2021.8, 2024. You may also enter a new vote by participating in the Annual Meeting and voting during the meeting. Your participation in the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request.

What is the voting requirement to approve each of the proposals?

Proposal 1, Election of Class I Director: Under the Company’s Bylaws, in order for a director nominee to be elected to the Board of Directors by the Company’s stockholders in an uncontested election of directors, he or she must receive an affirmative vote of a majority of the votes cast affirmatively or negatively. This means that the Class I director nominee will be elected to the Board of Directors at the Annual Meeting if the votes cast “for” the nominee’s election exceed the votes cast “against” the nominee’s election at the meeting, with abstentions not counting as votes “for” or “against.” If you do not instruct your broker how to vote with respect to this item, your broker may not vote your shares with respect to the election of the director. Abstentions and broker non-votes will not be taken into account in determining the outcome of the election of the director.

| Proposal | Vote Required for Approval | Effect of Abstentions | Broker Discretionary Voting Allowed (1) | Unmarked Signed Proxy Cards | ||||

1. Election of directors | The number of votes cast for a nominee exceeds the number of votes cast against that nominee. (2) | No effect | No | Voted “For” All Director Nominees | ||||

2. Non-binding advisory vote to approve the compensation of our NEOs | Majority of the votes cast affirmatively or negatively | No effect | No | Voted “For” | ||||

3. Ratification of appointment of independent registered public accounting firm | Majority of the votes cast affirmatively or negatively | No effect | Yes | Voted “For” |

An uncontested incumbent director is required to submit a contingent letter of resignation to the Board of Directors at the time of his or her nomination for consideration by the Nominating and Corporate Governance Committee of the Board. If such a director does not receive a majority of votes cast “for” his or her election, the Nominating and Corporate Governance Committee is required to consider on an expedited basis such director’s tendered resignation and make a recommendation to the Board concerning the acceptance or rejection of the tendered resignation. The Board is required to take formal action on the committee’s recommendation expeditiously following the date of certification of the election results. The Company will publicly disclose the Board’s decision and its reasoning with regard to its decision on the tendered resignation.

| (1) | If you are a beneficial owner whose shares are held of record by a broker, you must instruct the broker how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any proposal on which the broker does not have discretionary authority to vote. This is called a “broker non-vote.” Because broker non-votes are not voted affirmatively or negatively, they will not be considered in determining the number of votes necessary for approval and, therefore, will have no effect on the outcome of Proposal 1 or Proposal 2. |

| (2) | Pursuant to the Company’s Director Resignation Policy, an uncontested director is required to promptly tender to the Chair of the Board of Directors an irrevocable contingent resignation in the event that such director fails to receive a sufficient number of votes for election or re-election. The Nominating and Corporate Governance Committee of the Board is required to consider on an expedited basis such director’s tendered resignation and make a recommendation to the Board concerning the acceptance or rejection of the tendered resignation. The Board is required to take formal action on the Nominating and Corporate Governance Committee’s recommendation expeditiously following receipt, and the Company will publicly disclose the Board’s decision and, if applicable, its reasoning for rejecting the tendered resignation. |

Proposal 2, Advisory Vote on Executive Compensation: Our Board of Directors is seeking a non-binding advisory vote regarding the compensation of our NEOs, as described in the Compensation Discussion and Analysis, executive compensation tables and accompanying narrative disclosures contained in this Proxy Statement. Under the Company’s Bylaws, in order to be approved, this proposal requires an affirmative vote of a majority of the votes cast affirmatively or negatively. This means that the votes that stockholders cast “for” this proposal must exceed the votes that stockholders cast “against” this proposal at the meeting, with abstentions not counting as votes “for” or “against.” If you do not instruct your broker how to vote with respect to this item, your broker may not vote your shares with respect to the advisory vote on executive compensation. Abstentions and broker non-votes will not be taken into account in determining the outcome of the advisory vote on executive compensation. This vote is advisory and non-binding in nature, but our Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements.

Proposal 3, Ratification of Appointment of Independent Registered Public Accountants: Under the Company’s Bylaws, in order to be approved, this proposal requires an affirmative vote of a majority of the votes cast affirmatively or negatively. This means that the votes that stockholders cast “for” this proposal must exceed the votes that stockholders cast “against” this proposal at the meeting, with abstentions not counting as votes “for” or “against.” Abstentions will not be taken into account in determining the outcome of the ratification of the appointment of the Company’s independent registered public accountants.

What is the effect of abstentions and broker non-votes?

A stockholder may abstain with respect to each item submitted for stockholder approval. Abstentions will be counted as present for purposes of determining the existence of a quorum at the Annual Meeting. Abstentions will not affect the outcome of the election of the director (Proposal 1), the non-binding advisory vote on executive compensation (Proposal 2) or the ratification of the appointment of the Company’s independent registered public accountants (Proposal 3).

If you hold your shares in “street name” and do not direct your broker or other nominee as to how you want your shares to be voted in the election of the director (Proposal 1) or the non-binding advisory vote on the compensation of our NEOs (Proposal 2), your broker or other nominee is not permitted to vote those shares on your behalf on such proposal (resulting in a “broker non-vote” for each proposal for which your broker or other nominee does not vote your shares). Accordingly, if you hold your shares in “street name,” it is critical that you complete and return the voting instruction form if you want your votes counted in the election of the director (Proposal 1) and the non-binding advisory vote on the compensation of our NEOs (Proposal 2).

Broker non-votes are counted for general quorum purposes but are not entitled to vote with respect to any matter for which a broker does not have discretionary authority to vote. Broker non-votes will have no effect on the election of the director (Proposal 1) or the non-binding advisory vote on the compensation of our NEOs (Proposal 2). Because your broker or other nominee has discretion to vote any uninstructed shares on the ratification of the appointment of the Company’s independent registered public accountants (Proposal 3), broker non-votes are not expected to result from this proposal.

What does it mean if I receive more than one Notice, proxy card or voting instruction form?

It means your shares are registered differently or are held in more than one account. For each Notice you receive, please submit your vote for each control number you have been assigned. If you receive paper copies of proxy materials, please provide voting instructions for all proxy cards and voting instruction forms you receive.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results during the Annual Meeting and publish preliminary results, or final results if available, in a Current Report on Form 8-K within four business days of the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What happens if additional proposals are presented during the Annual Meeting?

Other than the three proposals described in this Proxy Statement, we do not expect any matters to be presented for a vote during the Annual Meeting. If you grant a proxy, the persons named as proxy holders, J. Boyd Douglas,Christopher L. Fowler, the Company’s President and Chief Executive Officer, and Matt J. Chambless,Vinay Bassi, the Company’s Chief Financial Officer, Secretary and Treasurer, will have the discretion to vote your shares on any additional matters properly presented for a vote during the Annual Meeting. If for any unforeseen reason, any one or more of the Company’s nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors.

What is the quorum requirement for the Annual Meeting?

The quorum requirement for holding the Annual Meeting and transacting business is a majority of the outstanding shares entitled to be voted and present at the meeting. The shares may be present in person or represented by proxy at the Annual Meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. If a quorum is not present or if we decide that more time is necessary for the solicitation of proxies, we may adjourn the Annual Meeting. We may do this with or without a stockholder vote. Alternatively, if the stockholders vote to adjourn the meeting in accordance with the Company’s Bylaws, the named proxies will vote all shares of common stock for which they have voting authority in favor of adjournment.

5

Who will bear the cost of soliciting proxies for the Annual Meeting?

The Company will pay the entire cost of soliciting proxies for the Annual Meeting, including the distribution of proxy materials. We will request brokers or nominees to forward this Proxy Statement to their customers and principals and will reimburse them for expenses so incurred. We have engaged Alliance Advisors LLC to assist in the solicitation of proxies and provide related advice and information support, for a services fee and the reimbursement of customary disbursements, which are not expected to exceed $20,000 in total. If deemed necessary, we may also use our officers and regular employees, without additional compensation, to solicit proxies personally or by telephone.

ELECTION OF CLASS I DIRECTORDIRECTORS

Our Certificate of Incorporation provides that the number of directors of the Company shall be fixed by resolution of the Board of Directors and divided into three classes. Directors in each class are elected for three-year terms. The current term of the Class I directors expires at the 20212024 Annual Meeting of Stockholders. The current Class II directors will serve until the 20222025 Annual Meeting of Stockholders and until their successors have been elected and qualified. The current Class III directors will serve until the 20232026 Annual Meeting of Stockholders and until their successors have been elected and qualified.

We currently have eight directors. Jeffrey A. Strong, a former Class I director, resigned from the Board of Directors effective October 23, 2020. On February 27, 2019, the Company entered into a Support Agreement (the “Support Agreement”) with Gilead Capital LP and its affiliates (collectively, “Gilead Capital”), pursuant to which the Company agreed to appoint Mr. Strong as an independent director of the Company, effective February 27, 2019. Pursuant to the terms of Section 1.1(h) of the Support Agreement, Mr. Strong offered in writing to the Board his resignation as a member of the Board and all committees thereof as a result of Gilead Capital ceasing to own on October 15, 2020 one-third of the total number of shares of the Company’s common stock that it owned on February 27, 2019. On October 23, 2020, the Board (by majority vote of the disinterested directors) accepted Mr. Strong’s offer to resign as a member of the Board and all committees thereof and approved a decrease in the size of the Board from nine directors to eight directors.

W. Austin Mulherin, III, who isCharles P. Huffman, a current Class III director, has decided not to stand for re-election tois retiring from the Company’s Board of Directors, when his term expires at the 2021 Annual Meeting. The Board approved a decrease in the size of the Board from eight directors to seven directors effective as of the conclusion of the2024 Annual Meeting, when Mr. Mulherin’s term expires.Meeting.

The Board of Directors has nominated each of Mark V. Anquillare and Glenn P. Tobin for election as a Class I director to serve a three-year term until the 20242027 Annual Meeting of Stockholders and until his successor has been elected and qualified. Pursuant to the Company’s Director Resignation Policy, each of Mr. Anquillare and Mr. Tobin has tendered an irrevocable contingent resignation letter. If Mr. Tobineither of them fails to receive a majority of the votes cast affirmatively or negatively at the Annual Meeting, the Nominating and Corporate Governance Committee of the Board of Directors will recommend to the Board, and the Board will determine, whether to accept or reject Mr. Tobin’sthe nominee’s resignation. Following the Board’s decision, the Company will file a Current Report on Form 8-K with the SEC in order to disclose the decision, the process by which the decision was made and, if applicable, the Board’s reason or reasons for rejecting the tendered resignation.

Unless otherwise instructed, the proxy holders will vote proxies held by them FOR the election of each of Mark V. Anquillare and Glenn P. Tobin as a Class I director. The Board anticipates that Mr. Anquillare and Mr. Tobin will each be able to serve, but if heeither of them should be unable or unwilling to serve, the proxies will be voted for a substitute selected by the Board, or the Board may decide not to select an additional person as a director or to reduce the size of the Board. Proxies cannot be voted for a greater number of persons than the number of actual nominees so named. Vacancies that occur on the Board of Directors may be filled by remaining directors until the next election of directors for the class in which the vacancy occurred.

The Board of Directors recommends that the stockholders vote FOR the Class I director nomineenominees named above.

Information About the NomineeNominees and Other Directors

The biographies of the nomineenominees and our other directors below contain information regarding each such person’s service as a director, business experience, director positions held currently or at any time during the last five years, certain familial relationships to any executive officers, if applicable, information regarding involvement in certain legal or administrative proceedings, if applicable, and, with respect to the nomineenominees and the continuing directors, the experiences, qualifications, attributes or skills that caused the Board of Directors to determine that the person should serve as a director. The nomineenominees currently servesserve as a directordirectors of the Company. The stock ownership with respect to each director and nominee for director is set forth in the table entitled “Security Ownership of Certain Beneficial Owners and Management.”

All of our directors bring to our Board a wealth of executive leadership experience, particularly at public companies and companies with healthcare and/or information technology operations. The following chart summarizes each continuing director’s key experience, qualifications and other attributes.attributes, including tenure as a director, and summarizes the demographic diversity of our Board.

Experience and Attributes | Regina M. Benjamin | J. Boyd Douglas | David A. Dye | Christopher T. Hjelm | Charles P. Huffman | Glenn P. Tobin | Denise W. Warren | |||||||

Accounting Expertise | ✓ | ✓ | ||||||||||||

Compensation | ✓ | ✓ | ✓ | |||||||||||

Cybersecurity / IT | ✓ | ✓ | ||||||||||||

Financial Expertise | ✓ | ✓ | ✓ | |||||||||||

Independence | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

Industry-Healthcare | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

Industry-Software/IT | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

International | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

M&A / Strategy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||

Operations | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

Public Company Executive | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

Public Company Governance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||

Risk Management / Compliance | ✓ | ✓ | ||||||||||||

Audit Committee Financial Expert | ✓ | ✓ | ||||||||||||

Racially and/or Ethnically Diverse | ✓ | |||||||||||||

Female | ✓ | ✓ | ||||||||||||

Tenure (Years) | 3 | 18 | 18 | 1 | 16 | 3 | 3 | |||||||

Other Current Public Boards | 2 | 0 | 0 | 0 | 0 | 0 | 1 | |||||||

Age (Years) | 64 | 54 | 51 | 59 | 67 | 59 | 59 |

7

| Experience and Attributes | Mark V. Anquillare | Regina M. Benjamin | David A. Dye | Christopher L. Fowler | Christopher T. Hjelm | Glenn P. Tobin | Denise W. Warren | |||||||

Accounting Expertise | ✓ | ✓ | ||||||||||||

Compensation | ✓ | ✓ | ✓ | ✓ | ||||||||||

Cybersecurity / IT | ✓ | ✓ | ||||||||||||

Financial Expertise | ✓ | ✓ | ✓ | |||||||||||

Independence | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

Industry-Healthcare | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

Industry-Software/IT | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

Industry-Revenue Cycle Management | ✓ | |||||||||||||

International | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

M&A | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

Operations | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||

Public Company Executive | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

Public Company Governance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||

Risk Management / Compliance | ✓ | ✓ | ||||||||||||

Audit Committee Financial Expert | ✓ | ✓ | ||||||||||||

Marketing / Public Relations | ✓ | ✓ | ✓ | |||||||||||

Regulatory / Public Policy | ✓ | |||||||||||||

Racially and/or Ethnically Diverse | ✓ | |||||||||||||

Female | ✓ | ✓ | ||||||||||||

Tenure as a Director (Years) | 1 | 6 | 22 | 2 | 4 | 6 | 6 | |||||||

Other Current Public Boards | 0 | 2 | 0 | 0 | 0 | 0 | 1 | |||||||

Age (Years) | 58 | 67 | 54 | 48 | 62 | 62 | 62 |

The following diversity statistics are reported in the standardized disclosure matrix that is required by the listing rules of the Nasdaq Stock Market (“Nasdaq”):

Board Diversity Matrix | ||||||||

Board Size: | ||||||||

Total Number of Directors: 8 | ||||||||

Gender:

| Female

| Male

| Non-Binary

| Gender Undisclosed | ||||

Number of Directors Based on Gender Identity | 2 | 6 | — | — | ||||

Number of Directors Who Identify in Any of the Categories Below: | ||||||||

African American or Black | 1 | — | — | — | ||||

Alaskan Native or American Indian | — | — | — | — | ||||

Asian | — | — | — | — | ||||

Hispanic or Latinx | — | — | — | — | ||||

Native Hawaiian or Pacific Islander | — | — | — | — | ||||

White | 1 | 6 | — | — | ||||

Two or More Races or Ethnicities | — | — | — | — | ||||

LGBTQ+ | — | |||||||

Demographic Background Undisclosed | — | |||||||

Class I NomineeNominees for Election – Term

Mark V. Anquillare was elected as a director on July 28, 2023. Mr. Anquillare served as President and Chief Operating Officer of Verisk Analytics, Inc. (a Nasdaq-traded company), a leading strategic data analytics and technology partner to Expirethe global insurance industry, from 2022, and as Chief Operating Officer from 2016, until his retirement in 2021January 2023. Prior to this role, Mr. Anquillare served as Verisk’s Chief Financial Officer from 2007 to 2016, significantly contributing to the company’s initial public offering in 2009 and leading the insurance vertical’s growth and innovation strategies. Before joining Verisk, Mr. Anquillare worked at Prudential Financial, focusing on life insurance and property and casualty operations.

The Board believes that Mr. Anquillare’s more than 30 years of financial and executive leadership, including developing and implementing short- and long-term plans, make him a valuable asset to the Board.

Glenn P. Tobin was first elected as a director in November 2017 and was appointed as Chairperson of the Board in April 2019. Mr. Tobin served as Senior Vice President—Accountable Care Solutions of The Advisory Board Company, a research, technology and consulting firm serving the healthcare and education industries, beginning in 2012. Mr. Tobin then served as the Chief Executive Officer of Crimson, The Advisory Board Company’s health analytics division, until his retirement in early 2017. Mr. Tobin also served as the Chief Operating Officer of CodeRyte, Inc. from 2010 to 2012 and held various executive positions within Cerner Corporation from 1998 to 2004. Additionally, he was a General Manager for Corporate Executive Board and was a consultant for McKinsey and Company.

The Board believes that Mr. Tobin’s extensive experience in the healthcare and technology industries, including in various leadership roles, contributes greatly to the Board’s composition.

Class II Continuing Directors – Terms to Expire in 20222025

J. Boyd Douglas has servedChristopher L. Fowler was appointed as CPSI’sthe Company’s President and Chief Executive Officer effective July 1, 2022, at which time he was appointed to the Board of Directors. Previously Mr. Fowler served as our Chief Operating Officer since May 2006. He was first electedNovember 2015 and as a directorthe President of TruBridge, LLC since its formation in January 2013. Prior to the formation of TruBridge, Mr. Fowler served as our Vice President—Business Management Services, beginning in March 2002.2008. Mr. DouglasFowler began his career with CPSIthe Company in August 1988May 2000 as a Software Support Representative and later as a manager of Financial Software Support Representative.Services. From May 1990August 2004 until December 1994,March 2008, Mr. DouglasFowler served as Manager of Electronic Billing,Assistant Director and from December 1994 until July 1999, he held the position of Director of ProgrammingBusiness Management Services. From July 1999 until May 2006, Mr. Douglas served as CPSI’s Executive Vice President and Chief Operating Officer.

9

Mr. DouglasFowler has been employed by CPSITruBridge for more than 3220 years in a number of positions and areas and has served in senior executive positions for over 2010 years, including as Chief Operating Officer and now as Chief Executive Officer, providing him with intimate knowledge of CPSI’sour operations and the healthcare industry.

Charles P. Huffman was first elected as a director at the 2004 annual meeting, and he served as Lead Director of the Board from November 2017 until April 2019. From August 2007 until his retirement in November 2008, Mr. Huffman served as Executive Vice President and Chief Financial Officer of EnergySouth, Inc., a public company specializing in natural gas distribution and storage. From 1998 to 2001, Mr. Huffman served as the Senior Vice President, Chief Financial Officer and Treasurer of EnergySouth, Inc., and from 2001 to July 2007, Mr. Huffman served as the Senior Vice President and Chief Financial Officer of EnergySouth, Inc.

The Board believes that Mr. Huffman’s years of experience as an officer of a public company, EnergySouth, Inc., including serving as the principal financial and accounting officer, give him a wide range of accounting, financial, capital markets and executive management experience that contributes greatly to the composition of the Board.

Denise W. Warren was first elected as a director in November 2017. Ms. Warren served as the Executive Vice President and Chief Operating Officer of WakeMed Health &and Hospitals, a 919-bed healthcare system with multiple facilities in the Raleigh, North Carolina area, from 2015 until her retirement effective December 31, 2020. Prior to this, Ms. Warren served as the Chief Financial Officer of Capella Healthcare, Inc. from 2005 to 2015. Ms. Warren began her career in 1980 with Ernst & Whinney (Ernst & Young), and then worked for a series of financial firms, including E. F. Hutton, Ford Capital, LTD, CS First Boston and Merrill Lynch & Co. Before joining Capella Healthcare, Inc., Ms. Warren served as Senior Vice President and Chief Financial Officer of Gaylord Entertainment Company and Senior Equity Analyst and Research Director for Avondale Partners LLC. She currently serves as a member of the board of directors and the compensation committee, as well as the chairperson of the audit committee, for Brookdale Senior Living, Inc. (a NYSE-traded company). She also serves on the boards of directors of Rockroom Insurance Group and the Raleigh Chamber of Commerce, and serves on the board of directors, as welland as the chairperson of the audit committee, for Virtusa, Inc., Straive and Newport Healthcare. Additionally, she serves as a director for Carteret County Community Foundation. Ms. Warren previously served on the boards of directors of HeartCare+ and CancerCare+, two collaborations with Duke University Health System, Rockroom Insurance Group, the Raleigh Chamber of Commerce, the American Heart Association—Middle Tennessee, and the Federation of American Hospitals; and served on the Vizient Central Atlantic Executive Board. Ms. Warren is National Association of Corporate Directors (NACD) Directorship Certified™. The NACD Directorship Certification™ program equips directors with the foundation of knowledge sought by boards to effectively contribute in the boardroom. NACD Directorship Certified directors establish themselves as committed to continuing education on emerging issues and to helping to elevate the profession of directorship. In 2020, Ms. Warren also received the Corporate Director’s Certificate from the Harvard Business School.

Ms. Warren brings more than 30 years of experience in operations, finance and executive management and has an extensive track record working with both public and private companies. The Board believes that Ms. Warren’s financial and accounting expertise and her substantial advisory experience in the healthcare industry make her a valuable asset to the Board.

Class III Continuing Directors – Terms to Expire in 20232026

Regina M. Benjamin was first elected as a director in November 2017. Dr. Benjamin served as the 18th United States Surgeon General and Vice Admiral of the U.S. Public Health Service from 2009 to 2013, and currently serves as the Chief Executive Officer of BayouClinic, Inc., which she founded in 1990. In 1995, Dr. Benjamin became the first person under age 40 elected to the American Medical Association Board of Trustees, and in 2004, she became President of the Medical Association of Alabama, making her the first African American female president of a state medical society in the nation. Dr. Benjamin is currently a member of the boardsboard of directors and audit committeescommittee of Oak Street Health,Doximity, Inc. (a NYSE-traded company) and ConvaTec (a London Stock Exchange-traded company). She also serves as an independent director of Professional Disposables International Inc., Kaiser Foundation Hospitals and Health Plan, Ascension Health Alliance, and Everlywell, Inc.Everly Health. Dr. Benjamin previously served on the boards of directors of Oak Street Health, Inc. (a NYSE-traded company), ConvaTec (a London Stock Exchange-traded company), Diplomat Pharmacy, Inc. and Alere Inc. (a NYSE-traded company).

Dr. Benjamin has substantial experience in the healthcare industry and has a deep understanding of the medical community and the dynamic regulatory and reimbursement environment. She has extensive expertise providing leadership in regulatory and compliance affairs to both public and private companies in the healthcare industry, which makes Dr. Benjamin a valuable asset to the Board.

David A. Dye has been a director since March 2002 and was appointed as Chief Operating Officer effective October 10, 2022, transitioning from his role as Chief Growth Officer to which he was appointed in November 2015. Mr. Dye served as Chairperson of the Board of Directors from May 2006 until April 2019, and was appointed as Chief Growth Officer in November 2015, having served as our Chief Financial Officer, Secretary and Treasurer from June 2010 until November 2015. Mr. Dye began his career with CPSIthe Company in May 1990 as a Financial Software Support Representative. From that time until June 1999, he worked for CPSIthe Company in various capacities, including as Manager of Financial Software Support, Director of Information Technology and then as CPSI’sour Vice President supervising the areas of sales, marketing and information technology. Mr. Dye served as CPSI’sthe Company’s President and Chief Executive Officer from July 1999 until May 2006, at which time he was appointed Chairperson of the Board. Mr. Dye served as a director of Bulow Biotech Prosthetics, a company headquartered in Nashville, Tennessee that operates prosthetic clinics in the Southeastern United States from July 2006 until October 2018.

Mr. Dye has been employed by CPSITruBridge for more than 30 years in a number of positions and areas and has served in senior executive positions for over 2220 years, including as Chief Executive Officer for over six years, and Chief Financial Officer for over five years and now as Chief Operating Officer, providing him with extensive knowledge of CPSI’sour operations.

10

Christopher T. Hjelm was first elected as a director in December 2019. Mr. Hjelm served as Executive Vice President and Chief Information Officer of The Kroger Company, a food retailing company, from September 2015 until his retirement in August 2019. Prior to this, he served as Senior Vice President and Chief Information Officer of The Kroger Company beginning in 2005. Mr. Hjelm currently serves on the board of directors of Inky Technology Corporation, a cyber-security company that secures emailswhose signature product uses machine learning and computer vision to secure email against phishing, on the investment committee for each of Connectic Ventures and Cintrifuse, andphishing. Mr. Hjelm also serves on the board of directors and the audit committee of Pomeroy Technologies, LLC.Wendal, a technology-based solution for venture capital. He is also a strategic advisor to RingIT, Inc. Mr. Hjelm previously served on the board of directors of Kindred Healthcare, Inc. (previously a NYSE-traded company), a healthcare services company that operates long-term acute-care hospitals and provides rehabilitation services across the United States.

The Board believes that Mr. Hjelm’s public board experience and over 25 years of senior-level technology leadership experience make him a valuable asset to the Board.

Class III Director – Not Standing for Re-electionContinuing

W. Austin Mulherin, IIICharles P. Huffman was first elected as a director at the 2004 annual meeting, and he served as Lead Director of the Board from November 2017 until April 2019. From August 2007 until his retirement in February 2002. Since 1991,November 2008, Mr. Mulherin has practiced law, handlingHuffman served as Executive Vice President and Chief Financial Officer of EnergySouth, Inc., a varietypublic company specializing in natural gas distribution and storage. From 1998 to 2001, Mr. Huffman served as the Senior Vice President, Chief Financial Officer and Treasurer of litigationEnergySouth, Inc., and business matters for publicfrom 2001 to July 2007, Mr. Huffman served as the Senior Vice President and private companies. He has been a partner in the law firmChief Financial Officer of Frazer, Greene, Upchurch & Baker, LLC since 1998.EnergySouth, Inc.

11

CORPORATE GOVERNANCE AND BOARD MATTERS

Our Board of Directors is committed to having sound corporate governance principles. Having such principles is essential to running our business efficiently and to maintaining our integrity in the marketplace. The “Corporate Governance and Board Matters” section of this Proxy Statement describes our governance framework, which includes the following features:

• Majority voting in uncontested director elections, combined with contingent resignations of directors

• 6 of 8 directors are independent • Independent Chairperson of the Board • Diverse Board that includes 2 females and 1 racially and/or ethnically diverse member • Annual Board and committee evaluations, as well as director self-evaluations, with focus on tangible improvements • Mandatory anti-corruption and anti-bribery training for directors • Board oversight of our compliance with the Vendor Code of Conduct and Human Rights Statement • Dedicated Board and management training related to medical billing and coding compliance • Mandatory retirement age for directors of 72, subject to exceptions granted by the Nominating and Corporate Governance Committee | • Chief People Officer partners with management to drive cultural change within TruBridge to foster the culture of innovation and inclusiveness that serves as our end-goal • Formal process for management evaluations, talent management and succession planning that is overseen by the Compensation Committee • Standing Innovation and Technology Committee oversees risks and strategy relating to cyber and data security and innovation and technology initiatives • Risk oversight by full Board and designated committees • Board committee oversight of Company’s environmental, social and governance (“ESG”) policies, disclosures and strategy • Stock ownership guidelines and equity retention requirements for executive officers and non-employee directors • No supermajority standards — stockholders may amend our bylaws or charter by simple majority vote |

We are committed to maintaining the highest standards of corporate governance and we engage proactively with our stockholders to discuss corporate governance, our compensation programs and any other matters of interest. Our stockholder engagement efforts allow us to better understand our stockholders’ priorities, perspectives and concerns, and enable the Company to effectively address issues that matter most to our stockholders.

Board, Committee and Individual Director Evaluation Program

Pursuant to the Corporate Governance Guidelines, the Board and each of its committees conduct an annual evaluation of its performance, led by the Nominating and Corporate Governance Committee. The evaluation is intended to determine whether the Board and its committees are functioning effectively and fulfilling the requirements set forth in the Corporate Governance Guidelines or the committee’s charter, as applicable. Beginning in 2018, theThe evaluations also includedinclude self-evaluations pursuant to which the directors wereare asked to examine their own contributions to the Board or committee, as appropriate, and potential areas of improvement. The Nominating and Corporate Governance Committee has formalized the following self-evaluation program, with the goal of placing additional emphasis on improvements to processes and effectiveness:

| Board and Committee members complete self-evaluations: These questionnaires are completed individually in order to encourage honest feedback from the directors. | |

| Group discussions: The Board or committee, as applicable, engages in a discussion of the completed questionnaires in order to assess performance in areas such as meeting efficiency, membership and structure, culture and operational effectiveness, and execution of roles and responsibilities. | |

12

| Focus on outcomes: The Nominating and Corporate Governance Committee discusses the outcomes of the Board and committee evaluations, determines appropriate follow-up action items and assigns responsibility for such actions. | |||

As a result of the2020 2023 evaluation process, the Board requested that management make certaindiscussed strategic adjustments to the Board’s composition and committee assignments, potential continued improvements to the financialmaterials and other materials provided toinformation that the directors before the quarterly Board meetings. The Board also requested thatreceive from management coordinate presentations at the Board meetings by various individuals to provide the directors with a deeper understanding of particular aspects of the Company’s business and a better knowledge of the members of senior management. Following the 2019 evaluation program, the Board worked with management to finalize the Company’s budget earlier in the year and the Board decided to formalize the practice of having a standing meeting of each committee in connection with each quarterly Board meeting. After the Board’s evaluation process in 2018, the Board took steps to improve the director onboarding process, increase educational and training opportunities for directors throughout the year, and implement a regular schedule of operational updatesdesire to increase engagement with various subject-matter experts on the Board from various areas of management.management team. The Nominating and Corporate Governance Committee is responsible for ensuring these action items, as well as others resulting from the evaluation process, are implemented throughout the year.

In March 2020, the World Health Organization (the “WHO”) declared the COVID-19 (coronavirus) outbreak a global pandemic, and throughout 2020 the Company’s management and Board took purposeful actions that prioritized the health and safety of our employees and their families and the continued service of our community hospitals and other healthcare systems and facilities. We took a number of actions specific to the health and safety of our employees and their families, including:

Management immediately responded to the crisis by moving to a nearly complete remote workforce and rapidly deploying remote collaboration tools in order to ensure uninterrupted communication among our employees and our customers.

The Company established internal social distancing, masking, quarantine and sanitation guidelines based on state and federal recommendations and provided personal protective equipment and initial temperature screenings to employees upon our return to the office environment, which was pursuant to a phased approach in keeping with state and local guidelines.

In order to ease the financial burden placed on affected employees and promote the use of alternative modalities of care, the Company waived telemedicine fees for participants in our self-insured health benefits plan.

Management upheld the Company’s commitment to our employees throughout 2020, and did not implement any pandemic-related furloughs, layoffs or compensation reductions.

We also took actions specific to the continued service of our community hospitals and other healthcare systems and facilities, including:

The Company rapidly developed and deployed the CPSI COVID-19 Toolkit, designed to provide healthcare providers and their clinicians with tools to safely and proactively engage with their communities in response to the pandemic. The Toolkit includes chatbots that use artificial intelligence and natural language processing to anticipate the needs of the patient to effectively triage them virtually via telehealth and texting tools, while also providing the latest COVID-19 information from the WHO, the Centers for Disease Control and Prevention (the “CDC”) and resources specific to the healthcare provider’s respective states.

Our service personnel engaged customers to help them navigate the complexities of the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act, including targeted discussions around the process for securing relief funds designed for healthcare providers.

Management accelerated the product roadmap for Get Real Health’s Talk With Your Doc telehealth portal, which was introduced for general release by April 2020 and was provided to customers free of charge for the remainder of the year.

Throughout 2020, management took action to preserve the Company’s cash reserves while awaiting the stabilization of the capital markets. The Company refinanced its indebtedness, suspended the dividend payments and initiated a share repurchase program, completing a strategic shift developed by the Board and management to use capital in a more opportunistic and flexible way. Management also made remote working permanent for many employees, resulting in physical space consolidation and both short-term and long-term cost savings. These cost savings, combined with other strategic and operational decisions during 2020, placed the Company in what management believes is a strong position heading into 2021.

Governance and Compliance Documents and Training

The Board of Directors has adopted Corporate Governance Guidelines that set forth the Company’s fundamental corporate governance principles and provide a flexible framework for the governance of the Company. The Corporate Governance Guidelines address, among other things, Board functions and responsibilities, management succession, Board membership and independence, Board meetings and Board committees, access to management, director orientation and continuing education, and annual performance evaluations, as discussed above under “Board, Committee and Individual Director Evaluation Program.” The Nominating and Corporate Governance Committee regularly reviews and reassesses the adequacy of the Corporate Governance Guidelines and recommends any proposed changes to the Board, and the full Board approves such changes as it deems appropriate.

We have adopted a Code of Business Conduct and Ethics that is applicable to all of our directors, officers (including our CEO and senior financial officers) and employees.employees and management conducts random audits to test compliance with the Code. We have also adopted a separate Code of Ethics with additional guidelines and responsibilities applicable to our CEO and senior financial officers, known as the Code of Ethics for CEO and Senior Financial Officers. Our Codes of Ethics are closely tied to our other compliance documents, including our Anti-Corruption Policy and our Gifts, Meals, Entertainment, and Travel Policy, which the Board of Directors adopted in early 2019. We have international operations, and as such compliance with all anti-corruption and anti-bribery laws is a key component of our ethics focus. In accordance with applicable laws, we prohibit improperly influencing business decisions or improperly securing advantages. Our compliance team conducts regular compliance training for our directors and annual compliance training for certain employees, and this dedication helps to ensure that our personnel are aware of their compliance obligations and well-equipped to meet them.

In 2022, we adopted a Human Rights Statement and a Vendor Code of Conduct and the Board oversees our compliance with these policies. The Human Rights Statement sets forth the Company’s commitment to promoting the protection of human rights through its business dealings and treating customers, employees and vendors with dignity. The Vendor Code of Conduct establishes minimum standards that must be met by all manufacturers, distributors, vendors and other suppliers regarding their treatment of workers, workplace safety and ethical business practices.

Our compliance team has developed and implemented a number of internal policies and procedures related to medical billing and coding compliance activity. These policies and procedures address, among other topics, customers’ external auditing activity, Medicare Credit Balance identification, timely resolution, reporting and internal auditing of these matters. Periodically, the directors receive in-depth education on the elements of an effective medical billing and coding compliance program, as well as their compliance oversight responsibilities.

Copies of the Corporate Governance Guidelines, the Code of Business Conductthese documents and Ethics, the Code of Ethics for CEO and Senior Financial Officers, the Anti-Corruption Policy, and the Gifts, Meals, Entertainment, and Travel Policypolicies are available on our website at http://investors.cpsi.cominvestors.trubridge.com under “Corporate Governance.”

ListingNasdaq listing standards of the Nasdaq Stock Market (“Nasdaq”) require that the Company have a majority of independent directors. Accordingly, because our Board of Directors currently has eight members, Nasdaq requires that five or more of the directors be independent. At the conclusion of the Annual Meeting, the Board of Directors will have seven directors,members, so four or more of the directors must be independent on or after May 13, 2021.independent. Nasdaq’s listing standards provide that no director will qualify as “independent” for these purposes unless the Board of Directors affirmatively determines that the director has no relationship with the Company that would interfere with the exercise of the director’s independent judgment in carrying out the responsibilities of a director. Additionally, the listing standards set forth a list of relationships that would preclude a finding of independence.

The Board affirmatively determines the independence of each director and nominee for election as a director. The Board makes this determination annually. In accordance with Nasdaq’s listing standards, we do not consider a director to be

13

independent unless the Board determines (i) that no relationship exists that would preclude a finding of independence under Nasdaq’s listing standards and (ii) that the director has no relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company) that would interfere with the exercise of the director’s independent judgment in carrying out his or her responsibilities as a director. Members of the Audit, Compensation and Nominating and Corporate Governance Committees must also meet applicable independence tests of Nasdaq and the SEC. Pursuant to the charter of the Innovation and Technology Committee of the Board, which was created by the Board effective October 28, 2020, the members of such committee must also qualify as independent under Nasdaq’s listing standards.

The Board of Directors has reviewed a summary of directors’ responses to a questionnaire asking about their relationships with the Company, as well as material provided by management related to transactions, relationships or arrangements between the Company and the directors and parties related to the directors. Following this review, the Board determined that all six of the non-employee directors are independent. In making this determination, the Board considered that, with respect to Mr. Mulherin, who is not a nominee for re-election, (i) Mr. Mulherin is a partner in a law firm that performs certain legal services for the Company, total payments for which have been less than $120,000 for each of the most recent three completed fiscal years, and (ii) Mr. Mulherin’s brother-in-law is employed by the Company as a sales manager.

At the conclusion of the Annual Meeting, the Board of Directors will have seven members, at which time all five of the non-employee directors will beare independent. Additionally, the Board determined that each current member of the Audit, Compensation, Nominating and Corporate Governance, and Innovation and Technology Committees, as well as each director who served on any of the committees during 2020,2023, also satisfies the independence tests referenced above.

The business of the Company is managed under the direction of the Board of Directors, which is elected by our stockholders. The basic responsibility of the Board is to lead the Company by exercising its business judgment to act in what each director reasonably believes to be the best interests of the Company and its stockholders. The Board oversees the business and affairs of the Company and monitors the performance of its management. Although the Board is not involved in the Company’s day-to-day operations, the directors keep themselves informed about the Company through meetings of the Board, reports from management and discussions with the Company’s NEOs. Directors also communicate with the Company’s outside advisors, as necessary.

The Board does not have a policy requiring the separation or combination of the CEO and Chairperson roles, but these positions have been separated since CPSI’sthe Company’s initial public offering in 2002. OnIn February 27, 2019, the Board elected Glenn P. Tobin, an independent director, as the Chairperson of the Board, effective as of the 2019 Annual Meeting. The Board has determined that it is in the best interests of the Company’s stockholders at this time to have an independent director serve as Chairperson of the Board. The Board believes this leadership structure effectively allocates authority, responsibility and oversight between management and the independent members of our Board. It gives primary responsibility for the operational leadership and strategic direction of the Company to our CEO, while the Chairperson facilitates our Board’s independent oversight of management, promotes communication between senior management and our Board about issues such as executive compensation, company performance, and management development and succession planning, and leads our Board’s consideration of key governance matters. As the Chairperson, Mr. Tobin presides at all meetings of the Board, including executive sessions of the independent directors, sets the agendas for Board meetings in consultation with the CEO and other directors, communicates the Board’s feedback to the CEO and communicates on behalf of the Board with various constituencies involved with the Company. In the event that the Chairperson of the Board is not independent, the Board can elect an independent director to serve in a lead capacity to coordinate the activities of the other independent directors and to perform such other duties and responsibilities as set forth in the Lead Director Charter.

Executive sessions of the independent directors of the Board of Directors are to be held at least two times a yearfollowing each regular quarterly Board meeting and otherwise as needed. Such sessions are chaired by the Chairperson of the Board, if such individual is independent under Nasdaq’s listing standards, by the lead independent director, if the Chairperson is not independent, or in the absence of an independent Chairperson or a lead independent director, by an independent director selected by a majority of the independent directors. The chairperson of the executive sessions also establishes agendas for such sessions.

Our management continually monitors the material risks facing the Company, including financial risk, strategic risk, operational risk, and legal and compliance risk. The Board of Directors is responsible for exercising oversight of management’s identification and management of, and planning for, those risks. The Board believes that an effective risk management system should be focused on (1) timely identifying the material risks that the Company faces, (2) communicating necessary information with respect to material risks to senior executives and, as appropriate, to the Board or relevant Board committee, (3) implementing appropriate and responsive risk management strategies consistent with the Company’s risk profile, and (4) integrating risk management into Company decision-making.

The Board has designated the Audit Committee to take the lead in overseeing risk management, and the Audit Committee has developed a risk management oversight program that is designed to assist the Board and management in identifying and prioritizing the Company’s material risks and, for each risk, assigning responsibility for oversight and designing and monitoring the status of a risk mitigation plan. In addition, the Board encourages management to promote a corporate culture that incorporates risk management into the Company’s corporate strategy and day-to-day business operations.

The Board has delegated to certain committees oversight responsibility for those risks that are directly related to their areas of focus. The Audit Committee reviews our risks related to the Company’s financial assets and liabilities, accounting and financial reporting. The Audit Committee is also responsible for coordinating the Board’s oversight of the Company’s risk-management program, including the process by which management assesses, prioritizes and manages the Company’s material risks. The Compensation Committee considers risk issues when establishing and administering our compensation program for executive officers and other key personnel. The Nominating and Corporate Governance Committee oversees matters relating to the composition and organization of the Board, and advises the Board how its effectiveness can be improved by changes in its composition and organization. Beginning in October 2020, the Nominating and Corporate Governance Committee also overseesas well as the Company’s efforts related to ESG policies and strategy as well asand ESG trends that may affect the Company’s business, operations, performance or public image.